Insurance deductibles have evolved from flat rates to flexible structures, allowing policyholders to customize coverage based on their preferences and financial goals. Deductible payment options enhance operational efficiency, streamline claims processing, and encourage responsible risk management. Consumers benefit from transparency, personalized plans, and informed decisions in managing out-of-pocket expenses for various repairs.

Deductible payment options have undergone a significant transformation, revolutionizing insurance processing. In this article, we explore how the evolution of deductible structures from flat to flexible models has impacted insurer efficiency and enhanced customer experiences. By offering more choices and promoting transparency, flexible deductibles empower policyholders while streamlining administrative tasks for insurers. Discover how these changes are reshaping the industry, improving both operational processes and client satisfaction.

- Evolution of Deductible Structures: From Flat to Flexible

- Impact on Insurer Efficiency: Streamlining Processing

- Enhanced Customer Experience: Choices and Transparency

Evolution of Deductible Structures: From Flat to Flexible

The evolution of deductible structures in insurance has marked a significant shift from flat deductibles to more flexible options. Historically, flat deductibles were the norm, requiring policyholders to pay a fixed amount out-of-pocket for claims. However, with the rise of deductible payment options, insurers now offer various structures tailored to individual needs. Flexible deductibles, for instance, allow policyholders to choose a higher deductible for lower premiums or opt for a lower deductible with higher costs.

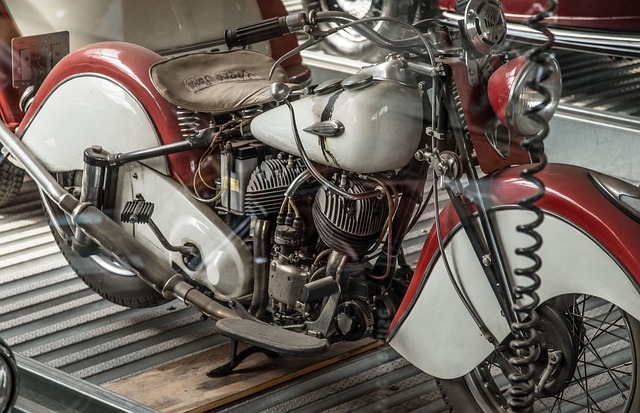

This change has revolutionized insurance processing, particularly in sectors like auto body shops and frame straightening centers. For example, when a car undergoes a comprehensive repair, including intricate frame restoration or extensive car body restoration, the flexible deductible option enables owners to manage their expenses more effectively. This shift empowers policyholders to prioritize their financial goals while ensuring they have adequate coverage for unforeseen incidents, such as accidents or natural disasters, that may require substantial auto body shop services.

Impact on Insurer Efficiency: Streamlining Processing

The introduction of flexible deductible payment options has significantly transformed the way insurance companies process claims, leading to enhanced operational efficiency. By allowing policyholders to choose deductibles that align with their financial comfort levels and risk appetite, insurers can now streamline their claim handling processes. This shift from rigid, one-size-fits-all deductibles to customizable options enables faster processing times. When a claim is filed, especially for relatively minor incidents like fender benders (often requiring collision repair services or body shop services), the pre-agreed deductible amount is promptly subtracted from the total cost of repair. This immediate adjustment simplifies the billing process and reduces administrative burdens on both the insurer and the policyholder, ensuring a smoother experience throughout.

Furthermore, these new payment structures encourage responsible risk management. Insurers can better predict claim costs and allocate resources more efficiently, potentially reducing overall operational costs. As a result, clients benefit from faster settlement times and reduced out-of-pocket expenses for minor repairs, fostering a more positive perception of the insurance industry, especially in the realm of automotive repair and body shop services.

Enhanced Customer Experience: Choices and Transparency

In today’s digital era, consumers expect transparency and choices when it comes to their financial transactions, including insurance claims. The introduction of flexible deductible payment options has significantly enhanced the customer experience by offering a range of personalized plans. This shift empowers policyholders to make informed decisions, balancing their out-of-pocket expenses with potential savings, especially in scenarios like an automotive restoration or auto glass repair.

By providing diverse deductible levels and payment methods, insurance providers ensure customers can choose what aligns best with their financial comfort and needs. For instance, a customer facing a fender bender might opt for a higher deductible with a lower monthly premium, while someone prioritizing a buffer against unexpected events could select a lower deductible at a slightly higher cost. This transparency fosters trust and satisfaction, creating a more positive experience throughout the claims process.

The evolution of deductible payment options has significantly transformed insurance processing, offering a more flexible and customer-centric approach. By shifting from flat rates to adaptable structures, insurers can streamline their operations, reduce administrative burdens, and enhance overall efficiency. This change not only benefits businesses but also provides policyholders with increased transparency and a greater sense of control over their coverage choices. As the industry continues to adapt, understanding these new deductible payment options is key to navigating the modern insurance landscape.