Tailored deductible programs allow drivers to customize auto insurance, balancing risk and savings. Lower deductibles cover more upfront but may save less over time, while higher deductibles reduce premiums and out-of-pocket repair costs. Digital age insurers offer flexible deductible options, empowering policyholders to manage expenses through preventive care and cost-saving choices. Compare quotes, review terms for discounts, and make informed decisions to enhance savings on deductibles and collision repairs.

Customized deductible programs offer a revolutionary approach to healthcare costs, allowing individuals to tailor their insurance coverage to specific needs. By understanding these programs, you can explore flexible deductible payment options and significantly reduce expenses. This article delves into the intricacies of customized deductibles, providing strategies to maximize savings. From tailored plans to innovative payment structures, discover how these programs can empower you to take control of your healthcare finances while ensuring comprehensive coverage.

- Understanding Customized Deductible Programs

- Exploring Flexible Payment Options

- Strategies to Maximize Savings on Deductibles

Understanding Customized Deductible Programs

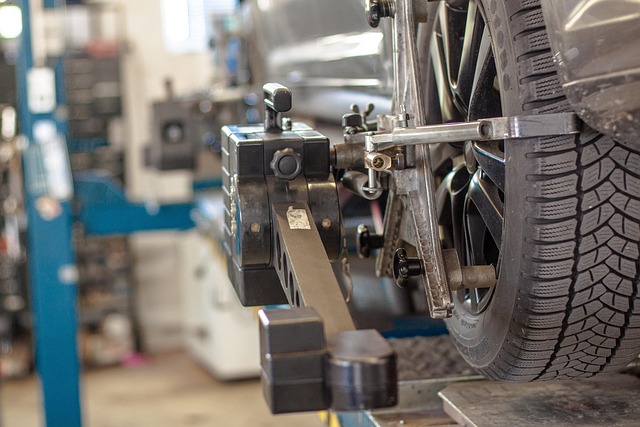

Customized deductible programs offer a unique approach to auto insurance, allowing policyholders to tailor their coverage to specific needs. By understanding these programs, drivers can make informed decisions about their vehicle’s protection. This involves evaluating various deductible payment options, which are the amount you agree to pay out-of-pocket before insurance covers the rest of the repair or replacement costs. It’s akin to balancing risk and savings; a lower deductible means higher upfront costs but potentially less financial burden in the long run, while a higher deductible can lead to significant savings on premiums.

These programs cater to different preferences, especially when considering out-of-pocket expenses for various vehicle services such as tire services, auto body repair, or vehicle bodywork. By customizing deductibles, drivers can ensure they’re prepared for unexpected repairs while aligning their insurance with their financial comfort level and the typical costs of maintenance and repairs for their specific vehicle models and usage patterns.

Exploring Flexible Payment Options

In today’s digital era, many insurance providers are offering flexible deductible payment options to cater to diverse financial needs. These customized plans allow policyholders to tailor their out-of-pocket expenses, providing significant savings opportunities. By exploring these adaptable payment structures, individuals can optimize their coverage while managing potential repairs efficiently. For instance, a comprehensive deductible option might include discounted rates for specific services like car body restoration or car paint services, ensuring that routine maintenance and unexpected incidents are both cost-effective.

This approach not only simplifies the financial burden of insurance but also encourages proactive vehicle care. Policyholders can choose to invest in preventive measures, such as regular inspections, which can prevent minor issues from turning into major, costly repairs. Whether it’s a bumper repair or a full body restoration, these flexible payment options provide a personalized and economical solution, ensuring drivers stay on the road safely and affordably.

Strategies to Maximize Savings on Deductibles

In the quest to optimize savings on deductible payments, understanding your insurance policy and deductibles is key. One strategy involves exploring different deductible payment options offered by your provider. Many policies now allow for customizable deductibles, giving policyholders control over their out-of-pocket expenses. By selecting a higher deductible, you can significantly reduce premiums, especially if you have a history of minor claims. This approach aligns well with those seeking cost savings on collision repair or vehicle body shop services, as it can lower overall costs.

Additionally, comparing quotes from multiple insurers is essential. Different companies may offer flexible deductible payment plans tailored to specific needs. For instance, when availing vehicle repair services, shopping around can unveil opportunities for substantial discounts. Reviewing policy terms and conditions related to deductibles is another savvy step. Some policies may include discounts or waivers for safe driving practices, regular maintenance, or certain safety features on your vehicle—all of which could further enhance savings on both deductible payments and collision repair expenses.

Customized deductible programs offer a flexible approach to healthcare costs, allowing individuals to tailor their coverage to specific needs. By exploring these plans and strategically maximizing savings on deductible payment options, folks can navigate today’s healthcare landscape with greater financial control and peace of mind.